As part of our ’10 Ways to …’ series which offers tips for parents on a variety of topics, here are our ‘10 Ways to Survive Working Outside of the Home and Being a Parent of Young Children’.

- Be organised: Over organise everything – lunches, dinners, clothes.

- Cook and freeze: At the weekend, cook some favourite meals and freeze them for during the week – the children can help, they love helping!

- Stop washing: Keep the laundry for Friday evening and finish it on Saturday. Most children have enough clothes to last the week.

- Sleep: Go to bed as early as you can and forget about the telly. Record your favourite programmes instead and watch at the weekend. If this isn’t possible then ask your friends what’s happening in soap land.

- Eat: Eat at work! Don’t go home hungry with hungry children, homework and whatever else you may face. Try to be ready for the onslaught when you get in the door.

- Public transport: Use it if you can as this way you can get some extra sleep, read, check texts, emails and have some ME time. If in your car, try to listen to some nice music and relax on the journey.

- Exercise: Do it on your lunch break as it will help keep the happy hormones alive. Just 15 minutes of fresh air will help you feel you are looking after yourself.

- Stay calm: Breathe and remember it will all be okay. Everything takes longer when you have children so expect the process of getting out in the morning or getting anything done to go slowly.

- Play: Allow time to play with your children in the evening. Quality time is as crucial as good nutrition – they will sleep better if they have time with you and share your day.

- Enjoy: Your children are little and life can be hard but they will grow up so fast so enjoy the pleasure they can bring you. Try not to worry so much about getting everything done, just try to get done what must be done.

The ’10 Ways to …’ series is compiled by One Family’s Director of Children and Parenting Services, Geraldine Kelly.

Coming soon: 10 Ways to Enjoy School Breaks, 10 Ways to Improve Listening in the Home, 10 Ways to Build and Maintain a Close Relationship with your Teenager, and 10 Ways to Healthier Eating.

The One Family parenting courses Positive Parenting and Family Communications are enrolling now for March. Click here for information.

As part of our ’10 Ways to …’ series which offers tips for parents on a variety of topics, here are our ‘10 Ways to Make Reading a Part of Family Life‘.

- Join the library. The whole family could take a trip to the local library and sign up. It’s free! Find out what’s happening in your local library as they run great events too and you can then plan your family trips to correspond with events.

- Read together. Plan a time each day, or at least three times a week, to read together. Let the children read to their parent or parents to child. When a child becomes familiar with a story they can tell it from the pictures or from their memory – encourage this!

- Start a library in your home. Go the second hand shops and get great books for very little cost.

- Switch off the TV. For one evening every week, switch on the story telling in the family instead of the telly.

- Start early. Introduce children to books from six months onwards; bath books, music books and picture books.

- Role model. Let children see you read books and use books to find out about things. Yes, there’s Google but let children know there are other ways too.

- Bring books. Wherever you go – when in the car, in a queue, on a bus trip going to Granny’s – bring a book with you. You can pass the time reading to your child or encourage them to read themselves if you are driving or talking with someone.

- Visit book shops. They can be great fun. Let children see all the books they can choose from. Talk to them about authors and check out when writers are signing in shops.

- Create your own book. Encourage older children (6+) to write their own stories and to create pictures about simple things they like in life. You could get them bound and keep them forever.

- The Benefits. Reading together creates quality time which results in improved relationships. It teaches children about the world and the people in it. It helps develop imagination, increases your child’s language and vocabulary which improves chances at school, and concentration levels grow as stories gets longer with age. At bed time, reading helps us relax and can enable children to fall asleep more quickly.

The ’10 Ways to …’ series is compiled by One Family’s Director of Children and Parenting Services, Geraldine Kelly.

Coming soon: 10 Ways to Enjoy School Breaks, 10 Ways to Improve Listening in the Home, 10 Ways to Build and Maintain a Close Relationship with your Teenager, and 10 Ways to Healthier Eating.

The One Family parenting courses Positive Parenting and Family Communications are enrolling now for March. Click here for information.

Press Release

Children & Family Relationships Bill provides first steps to a modern Family Law system in Ireland –

but One Family warns that family law courts need the resources to do their job properly for all children

(Dublin, Thursday 30 January 2014) One Family – Ireland’s leading organisation for one-parent families in Ireland today welcomes the publication of the Heads of the Children & Family Relationships Bill 2014 by Minister Alan Shatter. As an organisation that has campaigned for over 40 years for legal recognition and support for the wide diversity of families that children live in, we believe this Bill is a good first step that is long overdue.

Karen Kiernan, One Family CEO explains: “This Bill when enacted will provide a higher level of legal security for some of the diverse one-parent families that children live in. We are particularly pleased to see that people who have caring responsibility for children such as step-parents will be able to apply for guardianship, that it will be easier for extended family members such as grandparents to gain contact with their grandchildren and that more non-marital fathers will become guardians automatically of their children.”

However, One Family has some serious concerns about how aspects of the Bill can really be implemented given the serious resource restrictions that exist, and the lack of consistency and specialist knowledge that can characterise some family law proceedings and the requirement to hear children’s voices.

Kiernan continues: “We are very concerned about the lack of family assessments available to judges in family law courts which can be essential when upholding the principle of ‘a child’s best interest’. We have seen that it is extremely difficult to make nuanced and life-changing decisions without full, impartial information on what is going on in a family. A robust court welfare system will need to be put in place that can assess issues such as child protection, domestic violence, parental capacity so that judges can make informed, reasoned decisions. Such a system could also effectively hear the voice of children of all ages. The current Heads indicates that the costs of such reports, counselling, mediation or parenting courses as ordered by court will be borne by the parents involved and this is not realistic for many families.

It is time that a standardised, holistic, family-centred approach is taken to family law in Ireland where the starting point has to be the child and their family rather than the traditions of the legal system. The Bill is well-intentioned but will need an implementation plan with an attached budget to really make a difference.”

Part of what Minister Shatter is working to resolve is in relation to parenting orders and plans that are not adhered to. One Family offers a range of specialist counselling and parenting supports to people going through separation, sharing parenting of their children as well as those who parent alone. One Family also ran the two pilot Child Contact Centres over the past three years in partnership with Barnardos – a service that is now closed due to lack of government funding.

Karen Kiernan further explains: “Whilst much of this Bill is an excellent improvement on what was there, there is a big miss in relation to Child Contact Centres which are not mentioned. They have been proven to be needed and effective in reducing the dangers for children in high conflict families, in ensuring parenting orders work and in supporting families to move on to self-arranged contact. No Government department has been willing to continue funding them and they are not provided for in the Heads of Bill as a necessary service for courts.”

About One Family

One Family was founded in 1972 and is Ireland’s leading organisation for one-parent families offering support, information and services to all members of all one-parent families, to those experiencing an unplanned pregnancy and to those working with one-parent families. Children are at the centre of One Family’s work and the organisation helps all the adults in their lives, including mums, dads, grandparents, step-parents, new partners and other siblings, offering a holistic model of specialist family support services. These services include the lo-call askonefamily national helpline on 1890 622 212, counselling, and provision of training courses for parents and for professionals. One Family also promotes the Family Day Festival, an annual celebration of the diversity of families in Ireland today, with 10,000 people attending in 2013 (www.familyday.ie). For further information, visit www.onefamily.ie.

Available for Interview

Karen Kiernan, CEO | t: 01 662 9212 or 086 850 9191

Further Information/Scheduling

Shirley Chance, Director of Communications | t: 01 662 9212 or 087 414 8511

2014 is the 20th anniversary of the United Nations International Year of the Family. One Family has been working to mark this anniversary and marks the UN International Day of the Family every year here in Ireland.

One Family has signed up to the Declaration of the Civil Society on the occasion of the 20th Anniversary of the International Year of the Family.

We have developed links in relation to this anniversary and attended the Doha International Institute for Family Studies and Development (DIIFSD), The International Federation for Family Development (IFFD) and the Committee of the Regions of the European Union in cooperation with the Focal Point on the Family (UNDESA) European Expert Group Meeting ‘Confronting family poverty and social exclusion; ensuring work-family balance; advancing social integration and intergenerational solidarity’ as preparations for and observance of the twentieth anniversary of the International Year of the Family in 2014, in Europe.

We also founded a campaigning coalition called All Families Matter and we are seeking a progressive review of the Constitution in relation to the family.

Proposed activities to mark 2014 as the 20th Anniversary of the UN International Year of the Family

We are calling on the Government to designate a national Family Day.

15 May is the annual UN International Day of the Family and One Family requests that Minister Fitzgerald designates the nearest Sunday as a national Family Day in Ireland. In much the same way as we mark Mother’s Day and Father’s Day, we would like Family Day to also be celebrated. Our annual Family Day Festival will be held on 18 May 2014 again in the Iveagh Gardens and we will be again promoting our call to ‘Celebrate your family – Celebrate all families’ through all the schools, community and voluntary groups in Ireland.

We believe that this cost-neutral designation will send a powerful message to all families that this country respects and celebrates the reality of their lives through this national Family Day.

We are seeking support to hold a seminar to mark a number of significant reforms in relation to family life in Ireland. In a relatively short space of time the legal and social landscape in relation to families will change. Reforms that we are aware of include:

– The establishment of the Child & Family Agency

– Reform of the Family Law Courts

– Introduction of the Child & Family Relationships Bill

– Commitment to a referendum on marriage equality in 2015

– Social welfare reforms impacting on childcare, parenting responsibilities and family life.

2014 may provide an opportune time to reflect on these changes and to work towards a Constitutional reform of the definition of family which will inevitably be required at some stage. A conference or seminar will provide a forum for people to learn more about reforms and to look forward to a new vision of how our laws and policies can reflect the reality of the diversity of family life in Ireland today.

One Family also plans to highlight the year with a number of other smaller events which will be kicked off by a radio documentary on the founding of our organisation over 40 years ago which will be aired at 9am on Sunday 29 December on Today FM.

Press Release

New Report Proves Marriage is not Responsible for Children’s Well-being

(Dublin, Friday 20 December 2013) One Family, Ireland’s leading organisation for one-parent families, welcomes the launch today of the report ‘Growing Up in a One-Parent Family’, a study by researchers at the University of Limerick using the ‘Growing Up in Ireland’ data, published by the Family Support Agency.

A key finding of the study indicates that children from one-parent families and cohabiting families fare the same as children from married families when faced with similarly difficult conditions growing up. This is most detailed statistical study to date of the effects of family structure on child development, and concludes that the traditionally perceived benefits of marriage in relation to child development are not a result of marriage itself but of the parent or parents’ background.

Karen Kiernan, CEO of One Family, states: “This study confirms what One Family has known for years, based on our 41 years of experience working with one-parent families and our evidence-based knowledge, that it is not the legal structure of a family that is important to a child’s well-being but the substance of the family and the relationships within it. However, lone parents in Ireland continue to experience the highest rates of poverty and it is impoverishment that is proven to adversely affect a child’s future. We will continue in our vital work towards ending disadvantage for lone parents and their children.”

While the report also found that, despite controlling for school context and a variety of background factors, children from never-married one-parent families and cohabiting families did less well in their educational performance, it states that they are also more likely to be attending a disadvantaged – DEIS – school. Education and progression opportunities for parents are a core part of One Family’s work towards breaking the cycle of disadvantage.

The report ‘Growing Up in a One-Parent Family:The Influence of Family Structure on Child Outcomes’ is available to read/download here.

Notes for Editors:

- 1 in 4 families with children in Ireland is a one-parent family

- Over half a million people live in one-parent families in Ireland

- Almost 1 in 5 children (18.3%) live in a one-parent family (Census 2011)

- There are over 215,000 one-parent families in Ireland today (25.8% of all families with children; Census 2011)

- 87,586 of those are currently receiving the One-Parent Family Payment

- Those living in lone parent households continue to experience the highest rates of deprivation with almost 56% of individuals from these households experiencing one or more forms of deprivation (EU-SILC 2011)

About One Family

One Family was founded in 1972 and is Ireland’s leading organisation for one-parent families offering support, information and services to all members of all one-parent families, to those experiencing an unplanned pregnancy and to those working with one-parent families. Children are at the centre of One Family’s work and the organisation helps all the adults in their lives, including mums, dads, grandparents, step-parents, new partners and other siblings, offering a holistic model of specialist family support services. These services include the lo-call askonefamily national helpline on 1890 622 212, counselling, and provision of training courses for parents and for professionals. One Family also promotes Family Day, an annual celebration of the diversity of families in Ireland today, with 10,000 people attending events this year on 19 May (www.familyday.ie). For further information, visit www.onefamily.ie.

Available for Interview

Karen Kiernan, CEO | t: 01 662 9212 or 086 850 9191

Further Information/Scheduling

Shirley Chance, Director of Communications | t: 01 662 9212 or 087 414 8511

One Family has advocated for the Childcare Education and Training Support (CETS) Programme to be expanded to include CE Participants as the lack of access to affordable childcare is a barrier to participation for parents with young children, particularly lone parents. We are pleased to have received notification that it is being expanded from 1 January 2014 to include CE Participants.

Access to the CETS Programme for CE participants will mean participants can access childcare for the first time in the same way as participants pursuing FAS/VEC training courses.

An Information Leaflet for individuals wishing to avail of this scheme can be read/downloaded here: CETS Leaflet.

The Afterschool Childcare Scheme will also remain available in 2014. The Department has told us that it “is currently reviewing the criteria for this scheme based on the experience of the pilot with a view to ensuring that the scheme provides support at the most valuable point in time for our customers.” We will issue any updates as received.

Press Release

Government has hindered not helped

One-Parent Families in 2013

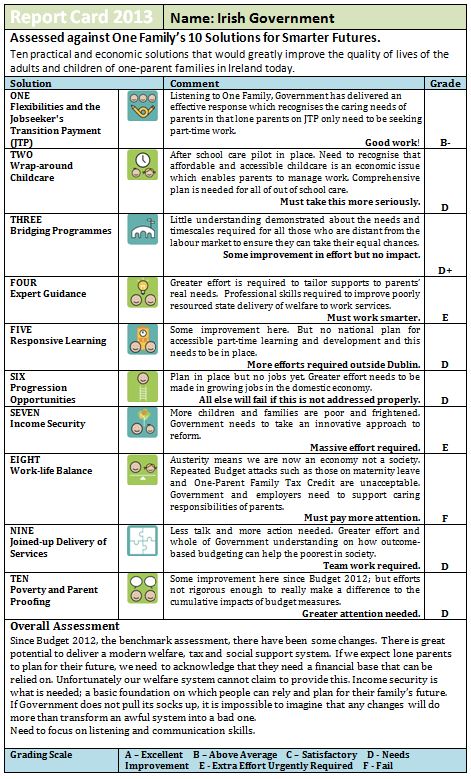

(Dublin, Tuesday 10 December 2013) One Family, Ireland’s leading organisation for one-parent families, campaigned for 10 Solutions. No Cuts. in the lead up to Budget 2014. These ten solutions are practical and economic measures that would greatly improve the quality of the lives of the adults and children of one-parent families in Ireland today. The campaign, a response to the harsh cuts of Budget 2012 that impacted disastrously on so many lone parents, was strongly supported by members of the public with hundreds of emails sent to TDs around the country.

So has Budget 2014 helped Ireland’s poorest families and children, and enabled lone parents to get back to work? One Family analysed the success or failure of Government to achieve each of its proposed 10 Solutions for Smarter Futures and awarded a score to each. The ‘Report Card’ below shows some small improvements but a very disappointing overall assessment with greater effort needed in most areas.

Karen Kiernan, CEO of One Family, states: “Following the dire cuts unleashed on one-parent families in Budget 2012, One Family has been providing solutions to government on how to help meet its own policy objectives of getting lone parents into sustainable employment. Government has followed some of what we have advised but it has a long way to go. There is deep and continuing dissatisfaction with the existing social assistance system from all quarters: community groups, business, politicians, the people who run the system and customers.”

Stuart Duffin, One Family’s Director of Policy, comments: “Budget 2014 needed to deliver opportunities and chances for all our families and in particular those parenting alone. As Enda Kenny says, ‘Work must pay’; but more importantly investment is needed to help families out of persistent poverty. Investment in resources and services will enable that move. If ‘work is to pay’ we need to look at how an efficient tax system can enable change; for example, Child and After School tax credits, moving FIS to being paid through the pay packet and on a sliding scale.”

Mr Duffin continues: “Budget 2014, despite being an opportunity to reward achievement, has in many ways – such as the ongoing slashing of the earning disregards and the abolition of the in-work One-Parent Family Tax Credit for both caring parents – nurtured perverse economic incentives to engage in the labour market. The integration of social and economic instruments should be a whole of government effort, to prevent unintended consequences.”

One Family’s assessment:

Notes for Editors:

- 1 in 4 families with children in Ireland is a one-parent family

- Over half a million people live in one-parent families in Ireland

- Almost 1 in 5 children (18.3%) live in a one-parent family (Census 2011)

- There are over 215,000 one-parent families in Ireland today (25.8% of all families with children; Census 2011)

- 87,586 of those are currently receiving the One-Parent Family Payment

- Those living in lone parent households continue to experience the highest rates of deprivation with almost 56% of individuals from these households experiencing one or more forms of deprivation (EU-SILC 2011)

For further information, visit www.onefamily.ie.

Available for Interview

Karen Kiernan, CEO | t: 01 662 9212 or 086 850 9191

Stuart Duffin, Director of Policy & Programmes | t: 01 662 9212 or 087 062 2023

Further Information/Scheduling

Shirley Chance, Director of Communications | t: 01 662 9212 or 087 414 8511

Later this week, the Department of Social Protection will be issuing letters to affected One-Parent Family Payment (OFP) recipients informing them that, from 1 January 2014, the OFP scheme’s income disregard will be reduced from its current amount of €110 per week to €90 per week for the duration of 2014.

In Budget 2012, it was announced that there would be a gradual reduction in the amount of earnings from employment that would be ignored (disregarded) when calculating the rate of OFP paid and that this change would come in over a number of years.

In 2012 the amount ignored was €130; in 2013 it is €110; in 2014 it will be €90; and it will decrease further to €75 in 2015 and €60 in 2016.

From 1 January 2014, you can have earnings of €90 without it affecting the rate of payment of OFP and so if your earnings are greater than €90 per week, then your rate of OFP will be changed to take this new rate into account.

It is important to note that if there has been any change in your circumstances which may affect your entitlement to One-Parent Family Payment, including a change in your weekly earnings, then you should notify your local social welfare office so that a review of your entitlement can be carried out, and if you have moved recently and not informed them of your new address yet, it is important to do so.

How might this change affect you? We have included a Q&A below based on commonly occurring situations.

askonefamily Questions:

Q. I have a letter to say that my One-Parent Family Payment will change in 2014 because I am working and earning €150 a week. Do I have to do anything?

A. No, the adjustment to your rate of payment will happen automatically; however if there are any changes in your circumstance such as a change of income then you should contact your local social welfare office to let them know of this.

Q. I earn €110 a week at the moment and still get the full payment for myself and my daughter. Does this change mean I will lose some of my payment next year?

A. Yes, the reduction from €110 to €90 means that you will now be means-tested as having €10 a week. You are only means tested on half of the difference, so for your earnings of €110 as the disregard will be €90 this leave €20 in the difference and you will then be means tested on half of this, which is €10 per week. This will mean a small reduction in your One Parent Family Payment. If your earnings from work are your only additional income you would expect to see a reduction in payment of €2.50 a week.

Q. I am working part time and earning €120 a week. Up until now this has been my only income apart from One-Parent Family Payment but my son’s Dad has got a job and is now going to be paying maintenance of €30 a week. What should I do?

A. As your income will increase once you start receiving maintenance because this is a change in your circumstances, you will need to let your local social welfare office know. Up to the first €95.23 of maintenance maybe disregarded if you have rent or housing costs.

If you would like any additional information about how your circumstances may be affected, please call our askonefamily national helpline on lo-call 1890 662 212 or email support@onefamily.ie.

An economic report revealing that the cost of childcare in Ireland is creating a barrier for parents who want to return to work, commissioned by the Donegal County Childcare Committee and conducted by Indecon International Economic Consultancy Group, was launched today by Minister for Children and Youth Affairs Frances Fitzgerald. The independent nationwide report, entitled Supporting Working Families – Releasing a Brake on Economic Growth, examines potential policy options to address the childcare obstacles that exist as a barrier to employment.

Key findings include:

- Annual Cost of Fulltime Childcare for Two-Child Family is €16,500

- Barriers to employment as a result of childcare costs are severe among lower income groups, with 56% prevented from looking for a job

- 26% of parents were prevented from returning to work or training because of childcare arrangements

- Ireland has second highest childcare costs in OECD as a percentage of average wages

One Family attended the launch today with our Director of Policy & Programmes, Stuart Duffin, responding:

“Finally a report that asserts childcare is a fundamental of economic policy and a service which underpins community economic development and growth. Access to quality childcare has major impacts on child poverty and on families’ quality of life more generally. We need to aim to encourage debate about the correct level of support childcare and how it is funded through a whole of government social investment.”

Government is charged to commit to protecting childcare spaces in both the short and long term, for families in transition and particularly for those parenting alone. For low-income parents, lack of access to quality and affordable childcare is a fundamental challenge to participation in the labour market[i]. Any loss of funding puts at risk the availability of community based care for children where families need it. Consequently, parents’ ability to work is jeopardised which subsequently makes vulnerable the entire childcare system and ultimately the economy as a whole. In the short term, enabling investment through tax credits and incentives must be committed to providing mechanisms and means to keep crèches intact. In the longer term, we must work together to secure the integrity and sustainability of the childcare system.

A clear pathway needs to be agreed on how to go to a tax based system from the current arrangement of FIS CETS and CCS as we see hard pressed working families struggling with childcare cost. Therefore we need to support access to good quality childcare through in-work supports. Currently, the danger is that the employment subsidy part of FIS (the income disregard) acts as a perverse incentive for lone parents and makes the cost of childcare unreachable.

Lone parents transitioning from social assistance to waged work should not be penalised and should gain financial benefit from this move. The “work incentives” currently in place as well as the continuing erosion of income disregards do not support parents entering the labour market[ii].

Government must initiate and commit to supports for low-income families to ensure they receive (tax) credits and assistance aimed at improving incomes, for example the Family Income Supplement. In-work assistance initiatives and supports improve the incomes of low-income families (and in particular those parenting alone). They are vital tools in engineering financial independence and mitigate the impact of increasing costs of taking up employment. Government must ensure that it pays to work: the cornerstone of the Government’s welfare to work strategy and future practice.

Currently, the tax and benefit system is unfair and traps people in poverty and unemployment. It is not possible to reform the system as it currently stands. It may be possible to reduce some of the worst aspects by tinkering with starting rates of tax and benefit tapers, but the inherent inequality in the way that tax-payers and benefits recipients are treated will remain. Policy-makers and politicians must take this opportunity to consider a total reconfiguring of the tax and benefits system. Without this, it is impossible to imagine that any changes will do more than transform an awful system into a bad one.

[i] EuroChild, (2012), Overall assessment of the SPC advisory report to the EC on “Tackling and preventing child poverty, promoting child well-being” & suggestions for future actions

[ii] ESRI,(2012), Budget Perspectives, Tax, Welfare and Work Incentives

One Family is extremely concerned by the Budget 2014 announcement of the replacement of the One Parent Family Tax Credit with a Single Person Child Carer Tax Credit as it causes a significant number of problems and possibly unintended outcomes.

The financial impact of abolition of the One Parent Tax Credit for the non-resident parent, as verified by Revenue, is:

| Annual wage | Difference in tax take per week |

| €13,500 (minimum wage x 30 hours) | No change |

| €20,000 | €13 |

| €30,000 | €10 |

| €40,000 | €48 |

| €60,000 | €47 |

The Revenue Commissioners estimates that for 2013, 76,800 income earners utilise some or all of the One-Parent Family Tax Credit. The gender breakdown is estimated as follows:

Female 51,224

Male 25,573

Total: 76,797

One Family has written to all Ministers, TDs and Senators to voice these concerns and urges everyone to write to their Representatives as soon as possible to do the same.

A proforma letter with suggested text that individuals can change as required is available to download here: One Parent Family Tax Credit_Letter to Representatives

A list of TDs and Senators including their contact details is available here.

One Family representatives have also participated in a number of press, radio and television interviews on the issue. You can read the press releases issued by One Family below:

17.10.2013 | Attack on Parents Sharing Parenting After Separation is Unjust, Unfair and Underhand

15.10.2013 | Budget 2014 is Anti-family and Anti-parent

Press Release

Attack on Parents Sharing Parenting After Separation

is Unjust, Unfair and Underhand

(Dublin, Thursday 17 October 2013) One Family, Ireland’s leading organisation for one-parent families, is deeply concerned by the removal of the One Parent Family tax credit and tax free allowance announced on Tuesday as part of Budget 2014 which will have disastrous and far-reaching consequences for separated Fathers and Mothers who share parenting of their children.

Stuart Duffin, Director of Policy and Programmes at One Family states: “Claimants of the One Parent Family tax credit are working Mums and Dads who are committed, responsible parents participating in a successful arrangement with their child’s other parent for the well-being of their child. This is an in-work support and the kind of mechanism that needs to be in place to deliver Pathways to Work, a cornerstone initiative of the Government’s recovery programme. Ultimately it is children who will be impacted with less money to go round in already hard hit families.”

The One Parent Family tax credit of €1,650 was previously available to both working parents sharing parenting after separation. From 2014, it is being replaced by a Single Person’s Child Carer tax credit of €1,650 which will only be available to the parent in receipt of Child Benefit. As the principle carer is usually the child’s Mother, and she may not be working, these changes mean that in many cases neither parent will now meet the specified criteria. Some parents may be at a loss of over €125 per month as a result of the removal of the one-parent family tax credit and the removal of the one-parent family tax rate.

Duffin continued: “One Family has a received a barrage of calls to the askonefamily helpline, plus emails and Facebook comments from worried parents who are already pushed to their limits. There is a lack of joined up thinking and policy between the Departments of Finance, Social Protection and Children & Youth Affairs as this government is penalising the good practice of shared parenting. One Family is actively calling for clarity and action to ensure that working parents don’t become welfare recipients.”

One Family warns Government that it must address implementation problems, otherwise this is going to create long-term challenges for parents.

Karen Kiernan, CEO of One Family, comments: “We are calling on Government to reverse this decision and to reinstate the relevant tax credits to ensure that one-parent families who are still coping with the cuts of Budget 2012 are not pushed further into poverty. We are concerned that along with other government measures this will damage the objective of making work pay and more people will end up becoming customers of the Department of Social Protection as many fathers have told us they simply won’t be able to pay as much maintenance as they have been.”

Concerned parents can contact the lo-call askonefamily helpline on 1890 662 9212 and email support@onefamily.ie.

Notes for Editors:

- 1 in 4 families with children in Ireland is a one-parent family

- Over half a million people live in one-parent families in Ireland

- Almost 1 in 5 children (18.3%) live in a one-parent family (Census 2011)

- There are over 215,000 one-parent families in Ireland today (25.8% of all families with children; Census 2011)

- 87,586 of those are currently receiving the One-Parent Family Payment

- Those living in lone parent households continue to experience the highest rates of deprivation with almost 56% of individuals from these households experiencing one or more forms of deprivation (EU-SILC 2011)

- Operational Challenges for Government to be addressed:

- If the principal carer is not working, can the allowance be claimed by the other parent?

- If the principal carer is not working and the allowance is claimed by the other parent, what happens when the principal carer returns to work?

- What about parents who share care 50/50?

- How will this be managed for parents who are already in dispute with each other following separation?

- Can clear provisions be made for flexibilities such as splitting the credit between working parents; and making it available to the working parent, usually the Father, who is often classed as ‘secondary carer’.

Available for Interview

Stuart Duffin, Director of Policy & Programmes | t: 01 662 9212 or 087 062 2023

Karen Kiernan, CEO | t: 01 662 9212 or 086 850 9191

For Case Studies, Further Information/Scheduling

Shirley Chance, Director of Communications | t: 01 662 9212 or 087 414 8511

One Family has summarised the announcements of Budget 2014 in relation to a number of areas of relevance to people parenting alone or sharing parenting.

Budget 2014People parenting alone and sharing parenting |

||

Changes to Social Welfare payments for 2014 |

||

| Basic rate of payment | The weekly rate of payment is staying the same in 2014 for all weekly social welfare payments for those of working age and pensioners. | No change. |

| One Parent Family Payment | There will be no change to the rate of payment in 2014.

For those in employment the new rate of income disregard of €90 a week will be introduced in 2014, reduced from €110 in 2013. This means that the first €90 of earnings will be ignored and half of the remainder of earnings will be assessed to give a new rate of One Parent Family Payment. |

No change.

Income Disregard reduced. |

| Child Benefit | The rate remains at €130 and this will be for each child, as announced in December 2012. | No change. |

| Maternity Benefit | The rate of payment will be standardised at €230 for new claimants; this is a change from a maximum payment of €262 and a minimum of €217.80. The change will come into effect from January 2014. | Payment standardised. |

| Fuel Allowance | Rate of payment will remain and there is no reduction in the number of weeks. | No change. |

Secondary Payments |

||

| Back to School Clothing and Footwear Allowance | Unchanged for all children under 18. In 2014 it will be paid for those aged 18 and over in secondary school but not for those in third level education. | No longer payable to children in third level education. |

| Fuel Allowance | It will remain at €20 a week for the 26 weeks. | No change. |

| Rent Supplement | No changes announced for single people with children but an increase in contribution for couples, from €35 to €40 weekly. | No change for single people with children. |

| Mortgage Interest Supplement | This scheme will be closed to new entrants and will be wound down over a four year period from January 2014 for existing recipients. | Closed to new entrants and winding down. |

One Parent Families in Work |

||

| Family Income Supplement | Household income thresholds remain at 2013 levels. | No change. |

| Income Tax, PRSI and Universal Social Charge | Unchanged in 2014. | No change. |

| One Parent Family Tax Credit | This is being replaced by a Single Person’s Child Carer tax credit of the same value – €1,650 – only available to the principal carer. | This tax credit of €1,650 was previously available to both working parents sharing parenting. Now only one parent – the principal carer – can avail of it.

One Family is actively clarifying a number of questions and concerns this change raises and will update in more detail as soon as possible. |

Other |

||

| GP Visits | Free GP care for children aged 5 and under announced. | Free GP care for children aged 5 and under announced. |

| Medical Card | Prescription charges increase from €1.50 to €2.50 for medical card holders. | Prescription charge increased to €2.50. |

| Third Level Students | The student contribution charge for third-level institutions will increase by €250 to €2,750 – increases by €250 until it reaches €3,000 in 2015. | Increased. |

| Primary School Books | A further €5m to be allocated to extend the books-to-rent in primary schools. | Increased. |

Press Release

More attacks on working mothers and shared parenting

Budget 2014 is anti-family and anti-parent

(Dublin, Tuesday 15 October 2013) One Family, Ireland’s leading organisation for one-parent families today responds to Budget 2014 noting the removal of the One Parent Family Tax Credit, the cutting of Maternity Benefit at the higher rate and no plans to help lone parents get into work.

Karen Kiernan, CEO of One Family, states: ‘We are extremely disappointed that working parents who share caring and financial responsibility for their children after separation are now to be penalised by the removal of the One Parent Family Tax Credit for one parent. We should be supporting both parents to cooperate and share responsibility for their children following relationship breakdown instead of penalising them. In addition, the adjusted Maternity Benefit payments, following on last year’s taxation of the Benefit, will negatively impact on thousands of working mothers.’

The One Parent Family Tax Credit has been available to both people sharing parenting of their children where they are not cohabiting and their child lives with them for part of the year. It was worth €1,650 per year in addition to the normal tax credit.

Stuart Duffin, Director of Policy and Programmes at One Family states: ‘We have been concerned for some time by incidences of social welfare inspectors investigating families because the parents after separating are sharing parenting of their children. One Family works to ensure that parents do their best for their children as they move through separation and into the often challenging landscape of shared parenting. This cut is retrograde. It ignores the reality of the collaborative approach many people can take to sharing responsibility and penalises families who have separated.’

Kiernan concludes: ‘One Family finds the ongoing negative approach to parents and families by this government to be alarming. People need support to balance their working and parenting responsibilities. It costs people more money to live apart and share parenting of their children than if they were living together and the removal of this Tax Credit will cause conflict in separated one-parent families.’

Notes for Editors:

- 1 in 4 families with children in Ireland is a one-parent family

- Over half a million people live in one-parent families in Ireland

- Almost 1 in 5 children (18.3%) live in a one-parent family (Census 2011)

- There are over 215,000 one-parent families in Ireland today (25.8% of all families with children; Census 2011)

- 87,586 of those are currently receiving the One-Parent Family Payment

- Those living in lone parent households continue to experience the highest rates of deprivation with almost 56% of individuals from these households experiencing one or more forms of deprivation (EU-SILC 2011)

Available for Interview

Karen Kiernan, CEO | t: 01 662 9212 or 086 850 9191

Stuart Duffin, Director of Policy & Programmes | t: 01 662 9212 or 087 062 2023

Further Information/Scheduling

Shirley Chance, Director of Communications | t: 01 662 9212 or 087 414 8511

Press Release

One Family Responds to Media Reports

of Social Welfare Fraud and

Notion of the ‘Undeserving Lone Parent’

(Dublin, Wednesday 9 October 2013) One Family, Ireland’s leading organisation for one-parent families, responds to recent reports of social welfare fraud and the targeting of claimants of one-parent family benefits by Department of Social Protection investigators.

Karen Kiernan, CEO of One Family, states: “We find it abhorrent that there are some two-parent families masquerading as lone parents in order to receive more social welfare than they are entitled to. Whilst the social welfare system needs an overhaul to ensure that resources are put most where they are needed, i.e. with poor children in poor families, fraud is not the answer as it hurts lone parents and their children, and others reliant on state support.”

Stuart Duffin, One Family’s Director of Policy, comments: “The dismantling and restructuring of social protection programmes have impacted disproportionately on women, especially lone parents, and shifted public discourse and images to welfare as fraud, thereby linking poverty, welfare and crime. Consequently, genuine lone parents can be demonised as welfare cheats. This almost criminalisation of poverty raises questions related to regulation, control, and the relationship between them, and it would behove the government to be extremely careful about their representation of fraud.”

There are three possible causes of irregular payments in the welfare system, fraud (dishonest intent), customer and/or third-party error and departmental error. An analysis by One Family which is available on www.onefamily.ie, has found that ‘Control Savings’– the internal performance indicator on the effectiveness of the Department of Social Protection’s (DSP) control measures, which has become a publicly quoted figure when the DSP wishes to report its efforts to reduce suspected fraud and error – is a poorly generated estimate. There is enough evidence to be concerned that the Department’s guidelines are not applied consistently across regions and that the predetermined multipliers used to generate estimated future savings do not accurately reflect return rates to welfare schemes.

According to an audit carried out by the Comptroller and Auditor General (C&AG), fraud and error in the Irish welfare system was estimated to be between 2.4% and 4.4% in 2010 (C&AG, 2011). This would seem to place it in a comparable position with the UK (2.7%), New Zealand (2.7%) and Canada (3-5%).

Ms Kiernan concluded: “It is time the media and policy makers stop perpetuating notions of the deserving and undeserving poor. Social welfare and other state supports should be based on evidence of need and from a perspective of equality and fairness, not from who is politically expedient to target.”

Notes for Editors:

- 1 in 4 families with children in Ireland is a one-parent family

- Over half a million people live in one-parent families in Ireland

- Almost 1 in 5 children (18.3%) live in a one-parent family (Census 2011)

- There are over 215,000 one-parent families in Ireland today (25.8% of all families with children; Census 2011)

- 87,586 of those are currently receiving the One-Parent Family Payment

- Those living in lone parent households continue to experience the highest rates of deprivation with almost 56% of individuals from these households experiencing one or more forms of deprivation (EU-SILC 2011)

- The document ‘One Family Analysis: DSP Control Savings Research’ is available to read and download here.

About One Family

One Family was founded in 1972 and is Ireland’s leading organisation for one-parent families offering support, information and services to all members of all one-parent families, to those experiencing an unplanned pregnancy and to those working with one-parent families. Children are at the centre of One Family’s work and the organisation helps all the adults in their lives, including mums, dads, grandparents, step-parents, new partners and other siblings, offering a holistic model of specialist family support services. These services include the lo-call askonefamily national helpline on 1890 622 212, counselling, and provision of training courses for parents and for professionals. One Family also promotes Family Day, an annual celebration of the diversity of families in Ireland today, with 10,000 people attending events this year on 19 May (www.familyday.ie). For further information, visit www.onefamily.ie.

Available for Interview

Karen Kiernan, CEO | t: 01 662 9212 or 086 850 9191

Stuart Duffin, Director of Policy & Programmes | t: 01 662 9212 or 087 062 2023

Further Information/Scheduling

Shirley Chance, Director of Communications | t: 01 662 9212 or 087 414 8511

With just ten days remaining until Budget 2014 on Tuesday 15 October, we are inviting everyone to support 10 Solutions. No Cuts. by taking one simple action on each of these ten days.

10 Solutions for Smarter Futures is our response to the harsh cuts aimed at lone parents in Budget 2012. These are changes that will benefit everyone, not just those on low incomes, as 10 Solutions for Smarter Futures is a series of ten no-nonsense, low or no-cost actions that Government can deliver to make life better for everyone.

How can you support the 10 Solutions campaign?

There are a number of things you can do. These include:

1. Email your local TDs – use our pre-populated email facility. It takes less than two minutes on this link.

2. Join and share the ‘10 Solutions. No Cuts.’ event on Facebook. You can also change your profile pic to a 10 Solutions pic (available here).

3. Share on Twitter via @1FamilyIreland and #10Solutions.

4. Ask your colleagues and contacts, family and friends to support the campaign for 10 Solutions by taking the actions above too.

Read more about 10 Solutions here.

Press Release

10 Solutions. No Cuts. Budget 2014.

(Dublin, Wednesday 18 September 2013) One Family, Ireland’s leading organisation for one-parent families, calls on Government to recognise that today’s challenging environment has impacted hardest on the 215,000 one-parent families in Ireland today, with those living in lone parent households suffering more than twice the national average rates of deprivation. We call for delivery of our low and no-cost 10 Solutions for Smarter Futures to improve the well-being of all families and ask that every parent and guardian of a child in Ireland take a few minutes to support our call for 10 Solutions to make life better for everyone. Let the Government know what lone parents need by taking action for 10 Solutions.

Members of the public can take action by:

- Emailing their local TDs – visit www.OneFamily.ie to use the pre-populated email facility. This takes less than two minutes.

- Share the ‘10 Solutions. No Cuts.’ event on Facebook via onefamilyireland.

- Share on Twitter via @1FamilyIreland and #10Solutions.

- Ask family and friends to support the campaign for 10 Solutions and take action too.

Almost 56% of individuals from one-parent family households experience one or more forms of deprivation (EU-SILC 2011). With 87,586 lone parents in receipt of the One-Parent Family Payment and 36% of these working, the evidence confirms that lone parents are striving to improve their lives and those of their children, and to contribute in a meaningful way to society. Yet Budget 2012 penalised lone parents and added to their struggle while current legislature creates numerous pitfalls for lone parents returning to work and education.

Karen Kiernan, One Family CEO, comments: “We have seen austerity budgets land squarely on the poorest families and children but there are better ways to support lone parents into sustainable work that will lift them out of poverty. Government needs to make sure no more cuts hit vulnerable one-parent families and they need to implement our 10 Solutions which will help make work pay.”

Stuart Duffin, Director of Policy & Programmes at One Family, notes; “Pitfalls for lone parents who want to return to work and education include: lack of affordable child care; lack of available jobs; training courses at times that suit parents. Simple things; but all of which can close doors for lone parents. We call on Government to take the pressure off lone parents and prioritise parents’ needs by delivering our 10 Solutions.”

One Family puts children at the centre of its work and believes that every child deserves an equal chance and every family deserves the same opportunities towards a fairer future.

10 Solutions. No Cuts.

It’s that simple.

Notes for Editors:

- 1 in 4 families with children in Ireland is a one-parent family

- Over half a million people live in one-parent families in Ireland

- Almost 1 in 5 children (18.3%) live in a one-parent family (Census 2011)

- There are over 215,000 one-parent families in Ireland today (25.8% of all families with children; Census 2011)

- 87,586 of those are currently receiving the One-Parent Family Payment.

- Those living in lone parent households continue to experience the highest rates of deprivation with almost 56% of individuals from these households experiencing one or more forms of deprivation (EU-SILC 2011).

About One Family

One Family was founded in 1972 and is Ireland’s leading organisation for one-parent families offering support, information and services to all members of all one-parent families, to those experiencing an unplanned pregnancy and to those working with one-parent families. Children are at the centre of One Family’s work and the organisation helps all the adults in their lives, including mums, dads, grandparents, step-parents, new partners and other siblings, offering a holistic model of specialist family support services. These services include the lo-call askonefamily national helpline on 1890 622 212, counselling, and provision of training courses for parents and for professionals. One Family also promotes Family Day, an annual celebration of the diversity of families in Ireland today, with 10,000 people attending events this year on 19 May (www.familyday.ie). For further information, visit www.onefamily.ie.

Available for Interview

Karen Kiernan, CEO | t: 01 662 9212 or 086 850 9191

Stuart Duffin, Director of Policy & Programmes | t: 01 662 9212 or 087 062 2023

Further Information/Scheduling

Shirley Chance, Director of Communications | t: 01 662 9212 or 087 414 8511

Some people will no longer qualify for the One Parent Family Payment (OFP) from 4 July 2013. If you are getting no other payment you may qualify for other income supports. A Jobseeker’s Allowance transition payment is available, which aims to support lone parents with children under 14 years of age back into the workforce. You need to make a new claim for these payments.

If you are working and are already getting a Family Income Supplement (FIS) your FIS payment will automatically increase when your OFP ends. This will partially make up for the loss of the OFP.

If you are unsure of what you can access and are struggling financially, please call our askonefamily Lo-call Helpline on 1890 662 212 or email us.

Q&A

1. Q. My payment is due to end in July as my youngest child is 18, can I avail of the Jobseeker’s Allowance – Transition scheme?

A: No, the Jobseeker’s Allowance – Transition scheme will only apply to those whose youngest child is under 14 so if you are applying for Jobseeker’s Allowance you will be subject to the full conditionality of being available for and genuinely seeking full time work.

2. Q. My payment is due to end in July and my youngest child is 11. I am working 5 mornings a week from 10 to 12 noon, can I apply for Jobseeker’s Allowance – Transition?

A: Yes, because your child is under 14 you can apply for Jobseeker’s Allowance – Transition and although you are employed for 5 days in the week you are still eligible for this payment, subject to the means test.

3. Q. I started receiving OPF in November 2011. My child is 14 now and my payment is going to end as the age conditions changes from 14 to 12 in July. What payment am I eligible for as I am job seeking already?

A: As your child is already 14 then you can apply for Jobseeker’s Allowance and you will need to meet the full conditionality of the payment of being available for and genuinely seeking full time work.

Press Release

One Family Reiterates Need for Social Justice for One-parent Families in Ireland

Today is UN World Day of Social Justice which aims to promote poverty eradication and social integration. The IMF ranks Ireland as the 15th in the world by GDP per capita yet 232,000 children are at risk of poverty, which represents 18.8% of all children in Ireland according to the Survey on Income and Living Conditions (SILC) in Ireland for 2011 released last Wednesday by the Central Statistics Office. The 2011 Census shows that there are 215,315 one-parent families in Ireland, accounting for 26% of all families with children, and 22% – almost 352,000 – of all children. SILC demonstrated that one-parent households are the most deprived, with 56% classified as deprived.

Stuart Duffin, One Family’s Director of Policy & Programmes, responds to the findings: “Our analysis of national studies – GUI, CSO ESRI – and evidence gathered by One Family over 40 years demonstrate that child poverty is not a natural phenomenon. It is a political phenomenon – the product of choices and actions made by government and society.”

Mr Duffin welcomes the recommendations in Investing in Children: Breaking the Cycle of Disadvantage (2013) spearheaded by László Andor, European Commissioner for Employment, Social Affairs and Inclusion, as today the European Commission adopts its new social investment package with a call for greater focus on social investment in the national reform programmes of all Member States. This report recognises that addressing child poverty is central to achieving Europe’s 2020 “smart, green and inclusive growth strategy”.

The Commission’s recommendations provide helpful guidance to the Irish State on how to tackle child poverty and promote children’s well-being. It calls for a children’s rights approach and integrated strategies based on three pillars:

- access to adequate resources;

- access to affordable quality services; and

- children’s right to participate.

One Family also calls on the Irish Government to identify the steps that should be taken to end child poverty in Ireland in line with the new EU recommendations as a matter of urgency.

/Ends.

About One Family

One Family was founded in 1972 and is Ireland’s leading organisation for one-parent families. We offer support, information and services to all members of all one-parent families, to those experiencing an unplanned pregnancy and to those working with one-parent families. Children are at the centre of One Family’s work and the organisation helps all the adults in their lives, including mums, dads, grandparents, step-parents, new partners and other siblings, offering a holistic model of specialist family support services. These services include the lo-call askonefamily national helpline on 1890 622 212, counseling, and provision of training courses for parents and for professionals. One Family also promotes Family Day, an annual celebration of the diversity of families in Ireland today, with events taking place this year on May 19th. For further information, visit www.onefamily.ie.

Available for Interview

Karen Kiernan, Director of One Family

Stuart Duffin, Director of Policy & Programmes

t: 01 662 9212

Media Release 30 June 2011

Following a HSE report earlier this week which found that over a third of women describe their pregnancy as a crisis pregnancy, One Family, the national organisation for one-parent families, announces a 10% increase in demand for its Welfare to Work services. The announcement is made in its 2010 Annual Report and Strategy, to be launched at The Coach House, Dublin Castle at 12 noon on Friday 1 July.

‘These Welfare to Work services support lone parents, some of whom have experienced a crisis pregnancy, into sustainable employment, ‘explains Karen Kiernan, Director of One Family, ‘Access to education and careers are vital gateways to move families out of poverty. Our courses show parents what is possible in their lives – and then support them to make the necessary changes to get there.’ (more…)

One Family, the leading provider of specialised support services for one-parent families in Ireland today, 7th December 2010, gives its response to Budget 2011. At a time when cutbacks were inevitable One Family had called on the Government to protect those already experiencing high levels of poverty and social exclusion from any more cuts.

‘But today’s many cuts – coupled with increases in taxes to be paid by those on low incomes – will have a devastating effect on one-parent families, many of whom are already living in poverty and struggling to combine work and caring responsibilities. In the absence of any clear jobs strategy the government has clearly not met its commitment to protect the most vulnerable from the effects of the crisis,’ says Candy Murphy, Policy Manager, One Family. (more…)

One Family, Ireland’s leading organisation for one-parent families, warns that any of the planned cuts in social welfare payments or in the minimum wage announced in the National Recovery Plan 2011-2014 will directly increase the thousands of one-parent families already living in poverty. (more…)