One Family Response to the Report ‘Indecon Independent Review of the Amendments to the One-parent Family Payment since January 2012’

A long-awaited report, prepared by Indecon Research Economists on behalf of the Department of Employment Affairs and Social Protection, was released late this afternoon. It is regrettable this this important report has been made available on the evening before Budget 2018 is scheduled to be announced, as it warrants attention that it may not now receive.

Our initial analysis of the 141-page report highlights that:

- While the Exchequer saves €45m net, lone parents and their children are poorer as a result of the recent reform of the One Parent Family Payment (OFP).

- It is an in-depth report yet no recommendations and only short conclusions are offered.

- Can any report guarantee accuracy if some of the survey questions from which the data is drawn provided only positive response options?

- Where is the recognition of the parenting responsibilities of lone parents? One Family is shocked that childcare appears to be mentioned only twice.

- Where too is the recognition of the impacts of the fear, stress, and uncertainty placed on lone parents and their children as a result of this reform; and the lack of clarity in its communication and implementation? 43% of parents reported that their family wellbeing decreased due to the reform and 40% said their children’s wellbeing decreased.

- There is no indication that the marginal increases in employment will have any longevity given the precarious and low paid nature of these employments, and 53% of survey respondents stated that the OFP reforms resulted in being financially worse off. Only 20% noted an improvement.

- 63% of the respondents in full-time employment stated that they cannot afford 3+ items on the deprivation list, meaning that they are most definitely experiencing deprivation daily, and in-work poverty.

- There is no acknowledgment that lone parents in education and in receipt of OFP or Job Seekers Transition Payment (JST) and rent support cannot avail of the SUSI maintenance grant.

The report acknowledges that “a potential concern is that many of those who lost OFP remain unemployed or in low paid or part-time employment” and that “a key challenge for policymakers is to assist lone parents to become more integrated into the Irish labour market.”

One Family’s Pre-Budget Submission includes recommendations that would enable Government to achieve this. The failure of the reform of the OFP means that it is essential that Minister Doherty engage with these recommendations.

They include:

- Full restoration of the Income Disregard.

- Allow BTEA and SUSI maintenance to be payable together, targeting those most distant from the labour market.

- Increased CDAQCI for older children and poorer families.

- Target employability supports for lone parents.

- It is also essential that, as we have consistently called for, the Department’s Case Officers receive training to support lone parents appropriately and in recognition of their lived realities.

One Family’s Pre-Budget Submission can be read here.

The Indecon report can be read here.

In recent months, much has been written and said about both the problems and benefits for one-parent families on social welfare that have been put through the One-Parent Family Payment (OFP) reform process. At the heart of this are the cuts in income faced by many parents who are working part-time and in receipt of social welfare.

In recent months, much has been written and said about both the problems and benefits for one-parent families on social welfare that have been put through the One-Parent Family Payment (OFP) reform process. At the heart of this are the cuts in income faced by many parents who are working part-time and in receipt of social welfare.

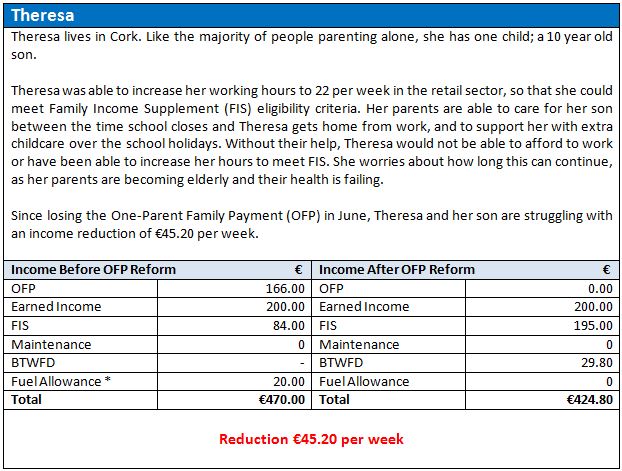

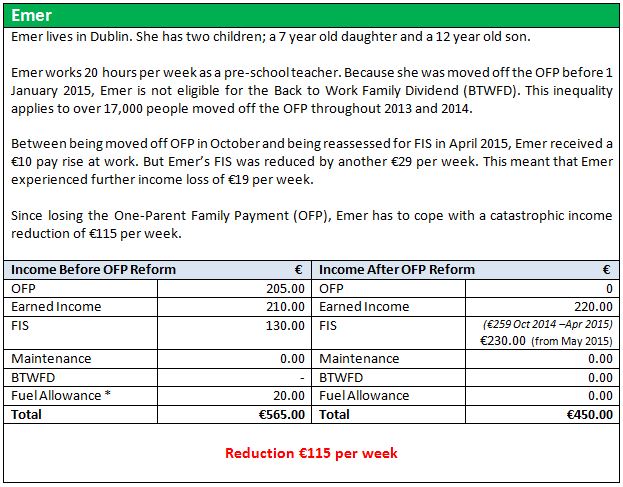

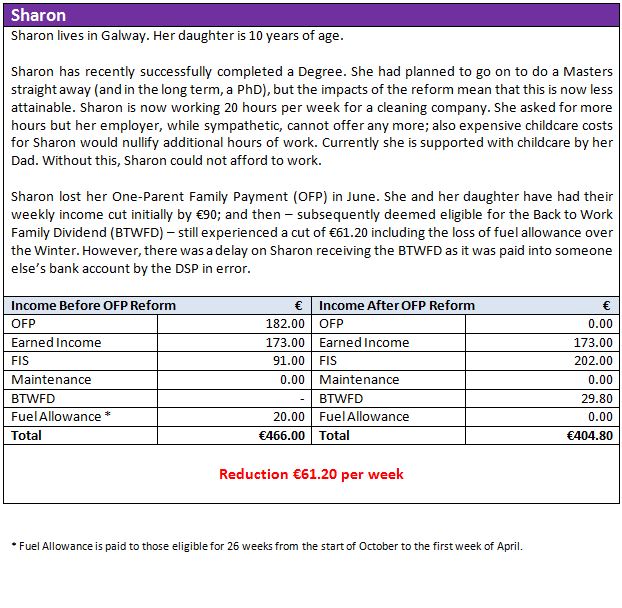

We asked Theresa, Emer and Sharon, each of whom is parenting alone, working part-time and has been recently transitioned from the OFP, to share the reality of their experiences of this reform process. Despite the fact that Theresa, Emer and Sharon is each doing what Government said this reform is supposed to enable – activation – all of their families have suffered a substantial financial loss. You can read what they told us below.

One Family believes that it is counter-productive to Government policy to enforce income losses on poor families when the objective of the reforms is to support people off welfare and out of poverty into sustainable employment. It is also counter-productive to imply that people parenting alone and in receipt of the OFP do not want to work. They do, and many are also in education.

These debates have not been helped by misinformation about how comparatively ‘well-off’ some families are on social welfare, or how much better off they could be in different circumstances; for example, if they were to increase their hours of part-time employment to become eligible for Family Income Supplement (FIS). One Family is responding clearly with some facts and the real-life case-studies of Theresa, Emer and Sharon in order to demonstrate the reality for the families we work with and represent.

Some facts in response to Government briefings:

- Atypical examples | It is unhelpful that atypical examples are being consistently put into the public domain, such as the example indicating that a lone parent with three children who works over 19 hours per week and qualifies for BTWFD will earn the same as a teacher. There are very few lone parents with three children (Census 2011 indicates 15.7% on all one-parent families, but this could be as low as 11% for those actually in receipt of a social welfare payment); the childcare costs associated with this atypical example are not factored in; and neither is the fact that BTWFD is only available at full rate for one year, is reduced completely after two, and is not available to those transitioned before 1 January this year. The ‘typical’ one-parent family includes one child (56.11%) or two children (28.17%).

- Other countries | Comparisons to other countries that require lone parents to be available for work when their children are younger than 7 are unhelpful and unrealistic as the structures in place in countries referenced such as New Zealand, the UK and the Netherlands are not comparable to Ireland due to the lack of available childcare here and other structural barriers. Also, there are far higher rates of investment in social services in these countries that practically enable parents to return to the work force.

- FIS | It is unhelpful to posit the gain that parents might get if they are able to increase their hours of work to over 19 whilst on the JSTA so that they become eligible for FIS, as this is extremely difficult for many to achieve. We are aware of many sectors, including government funded services, where people are unable to increase their hours. These commonly include childcare staff (particularly those providing ECCE hours); SNAs and other school staff who are frequently let go every summer; and retail staff who are subjected to zero hour contracts etc. It seems unrealistic that Government will be able to work with employers on this or that employers can be expected to always be in a position to create more hours, and it is unrealistic to expect employees to be able to demand more hours if those hours are not available.

- BTWFD | Since the reform introduction, some 17,000 lone parents have already transitioned from the OFP scheme to other income support payments in 2013 and 2014. This means that none of these parents were entitled to the Back To Work Family Dividend (BTWFD) which is supposed to support families to move from social welfare into employment.

- Childcare | The severe lack of affordable, accessible high quality childcare being uniformly available throughout Ireland remains a massive barrier. This problem for all families with children is far from being resolved; or any workable, time-lined potential solution been put forward by Government. Ireland’s childcare costs remain amongst the most expensive in the world, second only to the US. These reforms aimed to move more lone parents into the workplace are being implemented at a time when even many parents in working two-parent families feel they have no choice but for one partner to leave work owing to childcare costs being unaffordable. People parenting alone do not have a parenting partner to assist with childcare, school runs, school holidays etc. while at work and often do not have family support available.

- Income loss totals | Approximately 11,000 parents and families have lost income as a result of being transitioned to Jobseeker’s Transitional Allowance (JSTA) or Jobseeker’s Allowance (JSA) from the OFP. We do not yet know how many have or will gain financially, but we hope that this figure is high.

- Income loss amounts | The figures proposed by DSP of the losses that parents will face have been consistently under-estimated, based on testimony to One Family from many parents. We have heard of losses ranging from €30 to €140 per week. In the real-life case studies below, three parents clearly outline how they have lost from €45.20 to €115 per week.

Theresa, Emer and Sharon are all doing what Government says this reform process was implemented to support, and which should result in an increase in income: they are all working part-time over 19 hours per week and in receipt of FIS.

Press Release

End Child Poverty,

Get it Right for One-Parent Families

in Budget 2016

One Family will state at the Pre-Budget Forum tomorrow that Government has sacrificed lone parents and their children for long enough.

(Dublin, Thursday 2 July 2015) One Family, Ireland’s organisation for people parenting alone, sharing parenting and separating, will be participating in the Department of Social Protection’s Pre-Budget Forum tomorrow where CEO Karen Kiernan will call for an immediate review of Government’s current One Parent Family Payment (OFP) reform process. These reforms, on top of a sustained series of cuts targeting one-parent families – such as the reduction in Income Disregard and discontinuation of the One Parent Family Tax Credit – were implemented without supports including childcare in place, resulting in even greater poverty for thousands of Ireland’s most vulnerable families. Over 30,000 families have been moved off the OFP today.

Karen Kiernan, One Family CEO, states: “Government policy, despite the stated intent to support one-parent families out of poverty, is proving to be a monumental failure. Children in one-parent families are more than twice as likely to live in poverty. The number of children in Ireland living in consistent poverty – meaning they are living both at risk of poverty and experiencing deprivation – has risen to nearly 12%. When you analyse these figures, it reveals that 23% of children in a one-parent family experience deprivation. They have carried the burden of austerity on their shoulders as the poorest and most vulnerable in our society. What we are calling for in Budget 2016 is something that is long overdue. Put simply, it is time for a fair deal for one-parent families.”

Lone parents want to work and to access education so that they can create positive outcomes for their children, yet Government consistently implies that they need to be compelled to do so. This conveniently ignores the reality that barriers such as lack of accessible, affordable childcare/out of school care have yet to be removed. Lone parents already working part-time are those who are being most affected by the current process of reform as they are experiencing income decreases of up to €100 per week on already minutely managed budgets. Rather than giving away tax breaks or giving a miserly €5 per week in Child Benefit, Budget 2016 should be radical in its approach to investing in services for our poorest children and families.

Karen continues: “We are expressing loudly and clearly that Government must invest in Budget 2016 in a coherent package of supports and services for parents moved off the One-Parent Family Payment and to Job Seeker’s Allowances if it is serious about supporting lone parents into sustainable employment and out of social welfare. Quality, affordable childcare and out of school care; access to quality and assured housing; and family-friendly employment opportunities require significant government investment and cross-departmental collaborations. Without this, the Department of Social Protection’s reform process will continue to fail and families will continue to suffer.”

Budget 2016 must demonstrate a firm commitment from Government in working towards resourcing one-parent families rather than penalising them, and to work towards ending the shameful spectre of child poverty in Ireland.

One Family’s Pre-Budget Submission 2016 can be read/downloaded here. The Pre-Budget Forum takes place in the Printworks, Dublin Castle on Friday 3 July from 9am-2pm.

/Ends.

NOTES FOR EDITORS

One Family’s recommendations for Budget 2016 are simple, low cost and cost effective; and provide a social and economic future which is based on investment and opportunity.

A package of supports for OFP recipients being transitioned must include:

- The Income Disregard to remain at €90 for all OPFs regardless of their payment.

- Equal access to all activation measures and in particular MOMENTUM.

- Access to free fees for part-time education options.

- Allow JSTA CE participants to have an additional payment of €50/week equalising it with JobBridge in recognition of family costs.

- Provide specialist bridging programmes for lone parents such as New Futures and New Steps.

- Raise the Qualified Child Increase to help reduce child poverty by tailoring it to the poorest families.

- Recognise the value and costs of shared parenting by providing the Single

Person Child Carer Credit to each parent. - Adjust the Family Income Supplement so that it makes work pay for lone parents by reducing the qualifying hours to 15 hours per week and taper payment.

- Provide a high quality accessible Childcare and Out Of School Care system.

Previous Budget Cuts

Previous cuts that have targeted One-Parent Family Payment recipients since Budget 2011 include:

- Budget 2014

- The One Parent Family Tax Credit was discontinued and replaced with the Single Person Child Carer Credit, which only one parent can claim, whereas the previous credit could be claimed by both parents sharing parenting.

- Maternity Benefit was standardised at €230, an increase for some but a decrease of €32 for others.

- The FÁS training allowance was discontinued for those in receipt of some social welfare payments, including those receiving One Parent Family Payment.

- Budget 2013

- Child Benefit was reduced from €140 per child to €130 (for 1st, 2nd and 3rd child) in Budget 2013.

- Back to School Clothing & Footwear Allowance (BTSCFA): Reduced from €250 to €200 for children aged 12+, and from €150 down to €100 for 4-11 year olds.

- Cost of Education Allowance (paid with Back to Education Allowance, BTEA) cut completely from €300 down to €0 for all new and existing BTEA recipients.

- Budget 2012

- BTSCFA, from €305 reduced to €250 for 12+, and from €200 down to €150 for 4-11 yr olds; age eligibility also increased from 2 to 4 year olds in 2012.

- Ongoing cuts to OFP include Income Disregard cut from €146.50 down to €90.

- The half rate transition payment of OFP was cut for those who were going into work and stopping payment.

- OFP recipients lost access to half rate payment for Illness Benefit and Jobseeker’s Benefit, where applicable.

- Fuel Allowance was reduced from 32 weeks to 26 weeks.

- Cost of Education Allowance (for BTEA recipients) reduced from €500 to €300.

- CE Scheme participants, many of whom were lone parents, had their training and materials grant cut from €1,500 to €500; and new CE participants from 2012 could not get ‘double’ payment, just €20 extra allowance.

- Budget 2011

- Cuts included the main rate of social welfare payments reduced from €196 down to €188.

- Child Benefit was reduced by €10 for 1st and 2nd child / €150 to €140; 3rd child / €187 to €167; 4th and subsequent child / reduced to €177.

- Christmas Bonus was discontinued (half-rate partial reinstatement for some last year).

About One Family

One Family was founded in 1972 as Cherish and is Ireland’s leading organisation for one-parent families and people sharing parenting or separating, offering support, information and services to all members of all one-parent families, to those sharing parenting, to those experiencing an unplanned pregnancy and to professionals working with one-parent families. Children are at the centre of One Family’s work and the organisation helps all the adults in their lives, including mums, dads, grandparents, step-parents, new partners and other siblings, offering a holistic model of specialist family support services. These services include the lo-call askonefamily national helpline on 1890 66 22 12, counselling, and provision of training courses for parents and for professionals. One Family also promotes Family Day and presents the Family Day Festival every May, an annual celebration of the diversity of families in Ireland today (www.familyday.ie). For further information, visit www.onefamily.ie.

Available for Interview

Karen Kiernan, CEO | t: 01 662 9212 or 086 850 9191

Further Information/Scheduling

Shirley Chance, Director of Communications | t: 01 662 9212 or 087 414 8511

Press Release

Thousands of children are poorer today as government activation policy comes into effect

for 30,000 one-parent families with children aged 7

(Dublin, Wednesday 24 June 2015) Thursday 25 June is the last date of payment of the One-Parent Family Payment to over 30,000 families as their youngest child reaches 7 years of age. This is resulting in increased levels of consistent poverty for many vulnerable families. Two national organisations, One Family and the Society of St Vincent de Paul, have again highlighted the lack of supports put in place to minimise the impact on the families affected.

“The Tánaiste must act urgently to put the necessary resources in place to support families during this reform process. Government must ensure that the focus is on ensuring that levels of child poverty do not further rise. As organisations working with one-parent families, we understand the lived realities of these parents and children. We witness their struggle. This reform is failing them. It means that 11,000 families will immediately lose income, resulting in even more children living in poverty,” they say.

One Family and the Society of St Vincent de Paul say that a reform process that was meant to lift lone parents and their children out of poverty is clearly failing. Instead it is resulting in fewer parents being able to enter or stay in education, to up-skill, or to keep the part-time jobs they already have. The supports necessary to enable lone parents to return to education and employment, such as access to affordable, quality childcare, have not been introduced. This is counter-productive to Government’s stated aim to enable these lone parents to move out of the social welfare system.

Stuart Duffin, One Family Director of Policy & Programmes, comments: “Calls to our askonefamily helpline have increased by 50%. We hear from very anxious and worried parents. They want to work and want to learn. They are determined to create brighter futures for their children. They are doing their best to overcome systemic barriers but this is not something that can happen within a reform process that penalises so many already in part-time employment.”

John-Mark McCafferty, SVP Head of Social Justice and Policy, further comments: “At any time, half to two thirds of homeless families living in emergency accommodation are one-parent families. Many more of the one-parent families we work with are on the verge of homelessness. Years of cuts have led to one-parent families being those families in Ireland with the highest levels of consistent poverty with 63% of individuals from these households experiencing one or more forms of deprivation (EU-SILC 2013). This reform will lead to even more families experiencing poverty.”

Both One Family and the Society of St Vincent de Paul have consistently argued for a progressive mix of policies and action to support parents to enter and remain in the work place and in education.

“The success of Ireland’s employment strategies is not just about the achievement of current policy and delivery reforms. Ireland has experienced lower unemployment rates without the current reforms. Quality employment opportunities for one-parent families that support parenting choices should be the policy goal,” they say.

Over 30,200 lone parents will receive their last One-Parent Family Payment on 25 June as this reform process first announced in Budget 2012 continues to be phased in, and over 11,000 have already been transitioned. These parents are being moved to different payments; mainly to the newly introduced Job Seekers Transitional Allowance (JSTA) or to Job Seekers Allowance (JSA).

Parents affected by the reform can call askonefamily helpline for information and support on 1890 66 22 12.

FURTHER INFORMATION

Click here for more detailed information and analysis on the One-Parent Family Payment reform and child poverty on the One Family website.

AVAILABLE FOR INTERVIEW

Stuart Duffin, Director of Policy & Programmes, One Family | t: 01 662 9212 or 087 062 2023

John-Mark McCafferty, Head of Social Justice and Policy, Society of St Vincent de Paul | t: 087 236 3995

INFORMATION/SCHEDULING

One Family: Shirley Chance | t: 01 662 9212 or 087 414 8511

St Vincent de Paul: Jim Walsh | t: 087 254 1700

NOTES FOR EDITORS

Previous cuts that have targeted One-Parent Family Payment recipients since budget 2011 include:

- Budget 2013

- Back to School Clothing & Footwear Allowance (BTSCFA): Reduced from €250 to €200 for children aged 12+, and from €150 down to €100 for 4-11 year olds.

- Cost of Education Allowance (paid with Back to Education Allowance, BTEA) cut completely from €300 down to €0 for all new and existing BTEA recipients.

- Budget 2012

- BTSCFA, from €305 reduced to €250 for 12+, and from €200 down to €150 for 4-11 yr olds; age eligibility also increased from 2 to 4 year olds in 2012.

- Ongoing cuts to OFP include Income Disregard cut from €146.50 down to €90.

- The half rate transition payment of OFP was cut for those who were going into work and stopping payment.

- OFP recipients lost access to half rate payment for Illness Benefit and Jobseeker’s Benefit, where applicable.

- Fuel Allowance was reduced from 32 weeks to 26 weeks.

- Cost of Education Allowance (for BTEA recipients) reduced from €500 to €300.

- CE Scheme participants, many of whom were lone parents, had their training and materials grant cut from €1,500 to €500; and new CE participants from 2012 could not get ‘double’ payment, just €20 extra allowance.

- Budget 2011

- Cuts included the main rate of social welfare payments reduced from €196 down to €188.

- Child Benefit was reduced by €10 for 1st and 2nd child / €150 to €140; 3rd child / €187 to €167; 4th and subsequent child / reduced to €177.

- Christmas Bonus was discontinued (half-rate partial reinstatement for some last year).

/Ends.

About One Family One Family was founded in 1972 as Cherish and is Ireland’s leading organisation for one-parent families and people sharing parenting or separating, offering support, information and services to all members of all one-parent families, to those sharing parenting, to those experiencing an unplanned pregnancy and to professionals working with one-parent families. Children are at the centre of One Family’s work and the organisation helps all the adults in their lives, including mums, dads, grandparents, step-parents, new partners and other siblings, offering a holistic model of specialist family support services. These services include the lo-call askonefamily national helpline on 1890 66 22 12, counselling, and provision of training courses for parents and for professionals. One Family also promotes Family Day and presents the Family Day Festival every May, an annual celebration of the diversity of families in Ireland today (www.familyday.ie). For further information, visit www.onefamily.ie.

About One Family One Family was founded in 1972 as Cherish and is Ireland’s leading organisation for one-parent families and people sharing parenting or separating, offering support, information and services to all members of all one-parent families, to those sharing parenting, to those experiencing an unplanned pregnancy and to professionals working with one-parent families. Children are at the centre of One Family’s work and the organisation helps all the adults in their lives, including mums, dads, grandparents, step-parents, new partners and other siblings, offering a holistic model of specialist family support services. These services include the lo-call askonefamily national helpline on 1890 66 22 12, counselling, and provision of training courses for parents and for professionals. One Family also promotes Family Day and presents the Family Day Festival every May, an annual celebration of the diversity of families in Ireland today (www.familyday.ie). For further information, visit www.onefamily.ie.

About the Society of St Vincent de Paul The Society of St Vincent de Paul is the largest voluntary charity in Ireland. It works with a diverse range of people who experience poverty and exclusion. The main recipients of support from SVP are households with children with most people requesting assistance are those in receipt of social welfare payments or on low incomes. With a network of almost 11.000 volunteers home visitation to families, carried out in strict confidence, is the core work of the Society. Through person-to-person contact, the SVP is committed to respecting the dignity of those they assist and fostering self-respect. They assure confidentiality at all times and endeavour to establish relationships based on trust and friendship. SVP believes that it is not enough to provide short term material support. Those the SVP assist are also helped to achieve self-sufficiency in the longer term and the sense of self-worth this provides. When problems are beyond their competence, they enlist the support of specialised help. SVP is also committed to identifying the root causes of poverty and social exclusion in Ireland and, in solidarity with poor and disadvantaged people, to advocate and work for the changes required to create a more just and caring society. Other aspects of the Society’s work include operating over 150 charity shops; 14 hostels; 15 daycare centres; 10 holiday centres and 66 housing schemes. It also provides exam revision classes, after-school activities, homework clubs and breakfast clubs

About the Society of St Vincent de Paul The Society of St Vincent de Paul is the largest voluntary charity in Ireland. It works with a diverse range of people who experience poverty and exclusion. The main recipients of support from SVP are households with children with most people requesting assistance are those in receipt of social welfare payments or on low incomes. With a network of almost 11.000 volunteers home visitation to families, carried out in strict confidence, is the core work of the Society. Through person-to-person contact, the SVP is committed to respecting the dignity of those they assist and fostering self-respect. They assure confidentiality at all times and endeavour to establish relationships based on trust and friendship. SVP believes that it is not enough to provide short term material support. Those the SVP assist are also helped to achieve self-sufficiency in the longer term and the sense of self-worth this provides. When problems are beyond their competence, they enlist the support of specialised help. SVP is also committed to identifying the root causes of poverty and social exclusion in Ireland and, in solidarity with poor and disadvantaged people, to advocate and work for the changes required to create a more just and caring society. Other aspects of the Society’s work include operating over 150 charity shops; 14 hostels; 15 daycare centres; 10 holiday centres and 66 housing schemes. It also provides exam revision classes, after-school activities, homework clubs and breakfast clubs